Personal and Dependency Exemptions Eliminated

Effective date: tax year 2026 onward

The temporary suspension of personal and dependency exemptions under the TCJA has become permanent.

Whittier insight: Filers should still collect information regarding dependents, as this information is required to claim various other federal tax credits, correctly report taxable gifting, or assist with other state income tax filings and obligations.

A Temporary State and Local Tax (“SALT”) Deduction Expansion (Subject to Limitations)

Effective date: tax years 2025 through 2029

The SALT deduction has increased from $10,000 per filer ($5,000 for married filing separate (“MFS”) filers) to $40,000 per filer ($20,000 for MFS filers). However, the deduction is reduced by 30% of the filer’s modified adjusted gross income (“MAGI”), which is more than a threshold amount. For 2025, the threshold amount is set at a MAGI of $500,000 ($250,000 if MFS). The maximum allowable deduction and the MAGI threshold increase by 1% annually through 2029. (e.g., in 2026, the SALT cap will be $40,400 ($20,200 if MFS), and the threshold will be $505,000 ($252,500 if MFS). In tax year 2030, the cap will reset back to the TCJA-imposed $10,000 ($5,000 if MFS) limit.

Whittier insight: While this delivers a big win for filers earning up to $500,000 ($250,000 if MFS) who live in states with high state income and/or property taxes, the tax benefits will not change for filers whose MAGI leads to a complete phase out (i.e., income of $600,000 or $300,000 if MFS). Therefore, the pass-through entity tax (“PTET”) regimes (discussed later) will remain the primary method of generating federal tax deductions via flow-through business entities’ pre-payments of state income taxes.

Passthrough Entity Taxes (“PTETs”) Get the Green Light

Effective date: today and ongoing

The OBBB did not modify the availability of PTETs to bypass the federally imposed SALT deduction cap. Previous draft versions of the OBBB suggested changes that would have limited the amount or prohibited those eligible to benefit from such deductions. None of these provisions made their way into the final bill.

Whittier insight: Many states continue to offer workarounds that help business owners deduct state taxes at the federal level, and we expect the number of states adopting these methods to increase. These rules vary widely by state, so reviewing how they apply where filers live or operate is essential.

Charitable Contributions Have Changed

Effective date: tax year 2026 onward

For individual filers who itemize their deductions, only charitable contributions of more than 0.5% of the filer’s AGI will be deductible (subject to all the pre-existing charitable contribution limitations). However, this limitation will not apply to charitable contribution carryforwards from tax years preceding the effective date of the OBBB (i.e., tax years 2025 and prior). Furthermore, the increased contribution limitation from 50% to 60% of AGI for cash gifts to public charities, as modified by the TCJA, is permanent.

Whittier insight: Filers planning significant charitable giving may wish to accelerate donations to 2025, before the 0.5% AGI floor takes effect in 2026. However, filers should evaluate their specific tax situations. If they have made charitable contributions in past years that haven’t been fully deducted yet and have carried over, it may be beneficial to utilize those deductions before they expire. If their income composition shifts more towards ordinary (i.e., 37% rate) income versus capital gain (i.e., 20% rate) income in 2026 and onward, charitable contributions might make more sense then. Consider not only the amount, but the character of income.

The Qualified Business Income Deduction Gets a Refresh

Effective date: tax years 2026 onward

The TCJA created IRC Sec. 199A, colloquially known as the “qualified business income deduction”, which allowed individuals and trusts, depending on the amount and composition of their taxable income, to take a deduction of up to 20% of their qualified business income (“QBI”), real estate investment trust (“REIT”) dividends, and publicly traded partnership (“PTP”) income, subject to specific employee wage, capital investment, and business type limitations. In general, these businesses needed to be based in the United States.

The deduction is now permanent, with an increased phase-out range for middle-class filers who wish to take advantage of this benefit even if they participate in certain specified service trades or businesses (“SSTBs”) or otherwise do not pass the employee wage or capital investment limitations.

Whittier insight: The 21% corporate and 37% top marginal individual and trust tax rates enacted by the TCJA were no accident. They were set to equalize after-tax returns for investors in either structure. A corporation would face a 21% tax on earnings, leaving a residual 79%, which, if distributed as a qualified taxable dividend to its shareholder, would be taxed at 20%. The shareholder would end up with 63.2% (80% of 79%) as the residual. The owner of a pass-through entity would face a single layer of tax at 37%, leaving them with a residual of 63%. Congress enacted the 199A deduction to incentivize the formation and utilization of pass-through entities by making the effective tax rate on such income 29.6% (80% of 37%).

This deduction gives business owners and investors in pass-through entities (like LLCs, partnerships, and S corporations) a vital tax advantage. By making it permanent, the law helps ensure these businesses remain competitive with corporations.

A Welcome Liberalization of the Casualty Loss Rules (Giving the States More Power)

Effective date: tax year 2026 onward

Under the OBBB, if a filer’s home or property suffers damage in a disaster declared by their state government, not just the federal government, they can qualify for a casualty loss deduction. This change provides broader relief options for those impacted by wildfires, hurricanes, or other significant events.

Whittier insight: The increasing frequency and damage caused by natural disasters have necessitated an expedited process for making casualty loss deductions available. The OBBB provides much-needed relief to filers across the country facing these challenges.

Note that this does not allow a state official to defer the due dates for federal tax payments. That power continues to rest with the IRS.

The Deduction for Investment Management, Tax Preparation, Unreimbursed Employee and Hobby Expenses Is Eliminated

Effective date: tax year 2026

The temporary provisions eliminating the deductibility of these expenses are now permanent.

Whittier insight: Certain states (such as California) still permit deducting these items (subject to their existing 2% of AGI limitations), so filers should continue tracking them.

Itemized Deductions are no Longer Dollar-For-Dollar

Effective date: tax year 2026 onward

For filers in the highest (i.e., 37%) income tax bracket, itemized deductions are effectively capped at a 35% tax rate. For filers paying tax on capital gains at the highest (i.e., 20%) tax bracket, itemized deductions are effectively capped at a 19% rate. The overall itemized deduction limitation is calculated after the modified charitable contribution limitation (discussed earlier).

Whittier insight: While filers can still deduct certain expenses like charitable contributions, the OBBB slightly limits how much these deductions reduce their taxes if they are in the top tax bracket. This means that even if they donate an amount equal to their highest taxed income, they may still pay residual tax. This limitation may reduce the marginal benefit of deductions at the highest income thresholds and should be modeled in year-end planning scenarios.

Trump Accounts – Complex Rules, Long-Term Benefits

Effective date: July 4, 2026, and onward

In addition to IRAs, Section 529 plans, & ABLE accounts, the OBBB introduced an additional tax-savings vehicle, called “Trump accounts”. Trump accounts will generally be treated as tax-deferred (similar to a traditional IRA). Subject to specific requirements, these accounts will typically be available for individuals who have not yet reached 18 years old before the end of the tax year. Trump accounts may remain in existence after their beneficiary turns 18, and contributions can continue to be made, subject to the typical restrictions found in IRAs. After a beneficiary turns 18, Trump accounts may invest in assets besides collectibles, life insurance, and stock in an S corporation (similar to IRAs). Before that, they must generally invest in low-cost, unlevered index/mutual funds, primarily invested in US companies.

Trump accounts will only begin accepting contributions on July 4, 2026, and contributions can only be made in tax years preceding the tax year in which the beneficiary turns 18. Annual contribution limits apply (similar to IRAs) to Trump accounts, and distributions are only allowed on or after January 1 of the year the beneficiary turns 18. Upon maturity, distributions from Trump accounts generally follow the same rules as IRAs, in that they are partially taxable as ordinary income in the year of receipt, and non-qualifying early distributions may be subject to a 10% penalty.

The annual contribution limit is $5,000/year and adjusted for inflation after 2027. There is no exclusion from a filer’s gross income or income tax deduction for contributions to Trump accounts. Contributions to Trump accounts do not reduce the contribution limit to any other IRA plan besides a Trump account.

A one-time payment of $1,000 will be made to any Trump account established for eligible beneficiaries born in 2025 through 2029. There is no income limit for those who can receive the $1,000.

Whittier insight: Trump accounts represent another tool for individuals, families, and employers to start saving and investing for future generations, particularly because they do not have an earned income requirement. Unlike 529 accounts, Trump accounts do not appear to have any expense restrictions (although distributions would still be partially taxable); however, they also cannot be “super funded” like a 529 account with five years of contributions based on the contribution year's annual gift exclusion limit.

Other finer details apply, such as the manner and mechanisms of employer-provided contributions, or the treatment of Trump accounts in the case of a beneficiary's death. But in general, Trump accounts introduce a new vehicle for advisors to help filers accumulate tax-deferred wealth for the next generation.

Bonus Depreciation Comes Back

Effective date: January 20, 2025, onwards

Under the TCJA, bonus depreciation permitted a 100% deduction for qualified property generally placed in service between tax years 2018 and 2022. In 2023, this 100% deduction began phasing down by 20% per year and was set to expire in tax year 2027. The OBBB permanently extends the 100% depreciation deduction for qualified property acquired and placed in service after January 19, 2025. If desired, filers can utilize the pre-January 20, 2025, depreciation law for the 2025 tax year.

Whittier insight: The ability to immediately deduct large equipment or property purchases is back—but only for items placed in service on January 20, 2025, or later. When taking advantage of immediate expensing, consider other loss limitation rules, such as net operating, passive activity or excess business losses.

Research and Experimental Deductions Are Back (and Retroactive if They Qualify and Want to Be)

Effective date: tax year 2022 through 2024, if eligible; otherwise, tax year 2025 onward

Under the TCJA, research and experimental expenses were fully deductible in the year they were incurred, regardless of location. Starting in tax year 2022, such expenditures were required to be deducted ratably over 5 years (for domestic costs) and 15 years (for foreign costs).

The OBBB now permits a full deduction for domestic research and experimental expenses starting in tax year 2025. Foreign expenses must still be deducted ratably over 15 years. Filers may also elect to fully deduct any outstanding amounts incurred in tax years 2022-2024 that have not yet been deducted. This acceleration can occur in tax year 2025, or ratably over 2025 and 2026. Certain eligible small businesses (generally defined as those with average annual gross receipts of $31 million or less) may elect to retroactively apply immediate deduction and amend tax years 2022-2024, if desired. Such an election must be filed before July 4, 2026.

Whittier insight: During the passage of the TCJA, Congress drafted IRC Section 174 to limit research and experimental deductions in tax years 2022 onward to lower the bill’s ultimate price tag. While there was general bipartisan support for maintaining full expensing, no legislative remedy was enacted. The OBBB fixes that.

If filers have incurred domestic R&D costs, they may be able to accelerate those deductions, improving their current year tax posture. This change is beneficial for growing companies that have yet to profit.

Expanded Interest Deductibility Restores Debt Planning Appeal

Effective date: tax year 2025 onward

Before the OBBB, starting in tax year 2022, businesses were generally only permitted to deduct business interest expense so long as it did not exceed 30% of their earnings before interest and taxes (“EBIT”). Starting in tax year 2025, businesses can now deduct business interest expense so long as it does not exceed 30% of their earnings before interest, taxes, depreciation, amortization, and depletion (“EBITDA”). This change is also permanent.

Whittier insight: Allowing the add back to EBIT for depreciation, amortization, and depletion deductions, in combination with the bonus depreciation provisions, represents a notable win for filers in capital-intensive businesses that utilize a high degree of debt.

Inflation Reduction Act, We Hardly Knew Ye

Effective date: July 4, 2025, and onwards

A sizable portion of the OBBB’s revenue increases came from curtailing green energy tax credits introduced in the previous administration's Inflation Reduction Act. Though there are too many credits to list in this summary, the OBBB made changes that accelerated the winddown, restricted transferability, and limited the population of filers eligible to claim said credits. Solar, wind, and electric vehicle credits were the primary targets for curtailment, while others, such as nuclear and geothermal, were left relatively intact.

Whittier insight: Originally thought to be a straightforward political rebuke of the Inflation Reduction Act, the repeal of these credits became a delicate negotiating issue, as significant amounts of working capital and jobs reside or will reside in states with legislators who voted in favor of the bill.

Investing in Small Businesses Taxed as C Corporations Is More Attractive Now Than Ever

Effective date: tax years 2026 onward

The 100% qualified small business stock (“QSBS”) gain exclusion has been expanded. For qualifying corporate stock acquired after July 4, 2025, a noncorporate filer is permitted to exclude 50% of the capital gain for stock held for three years or more, 75% for stock held for four years or more, and 100% for stock held for five years or more. The previous QSBS rules required a five-year hold period.

The maximum amount of excludible gain is increased from the greater of $10m or 10 times the filer’s basis to the greater of $15m or 10 times the filer’s basis and is adjusted for inflation thereafter. Furthermore, the corporation's gross asset ceiling has been raised from $50m to $75m and adjusted for inflation. There are no changes to IRC Section 1045, which permits tax-deferred rollovers of otherwise qualifying small business stock (but for the qualifying holding period) into another qualifying small business stock investment.

Whittier insight: Because of these changes, we anticipate an increase in individuals seeking investments in C corporations. Once generally viewed as an obscure provision of the Internal Revenue Code, relegated to venture capitalists and business founders, appears to be becoming more mainstream.

Expanding and Making Permanent the Estate and Gift Tax Applicable Exclusion (Including the Generation-Skipping Tax)

Effective date: tax years 2026 onward

The 2026 estate and gift tax applicable exclusion is set to $15m per person ($30m per couple) and adjusted for inflation thereafter. Absent modification, the current exclusion was set to halve in tax year 2026. The generation skipping tax (“GST”) has also been expanded to the same $15m per person ($30m per couple) limit, allowing such incremental transfers also to be made tax-free to skip persons, typically defined as individuals or beneficiaries who are two or more generations removed from the transferor.

Whittier insight: The 2025 maximum estate and gift tax applicable exclusion was set to $13.99m per person ($27.98m per couple). With the expansion to $15m per person ($30m per couple) starting in 2026, filers who have previously maximized the utilization of the lifetime exclusion can now benefit from an additional ~$1m per person (~$2m per couple) of gifting and/or transfers out of their taxable estates.

Summary

These are just the key changes impacting HNWIs. Many more remain undiscussed or require future investigation (e.g., Opportunity Zones, treatment of gambling losses, and various international provisions).

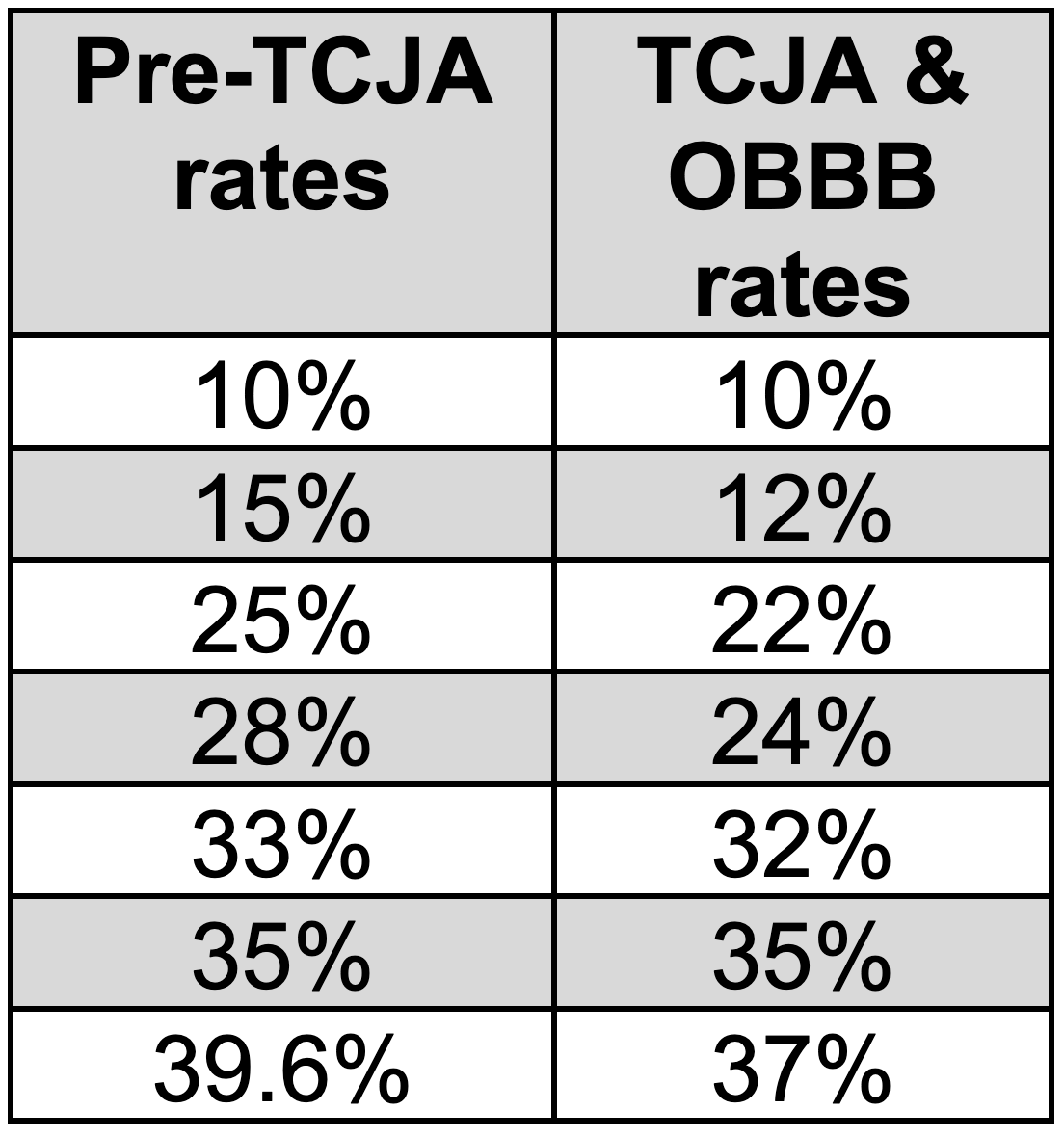

In general, the OBBB aims to restore the tax landscape back to the TCJA and make it permanent. The OBBB represents a growing trend in tax legislation. What was once a bipartisan process with cumbersome processes and procedures has increasingly become a partisan tool for enacting sweeping fiscal change, passed by razor-thin margins.

We note that the government’s fiscal year resets on October 1, 2025, and Congress may utilize the budget reconciliation process again in the subsequent fiscal year. The potential for another reconciliation bill before the year ends remains within the realm of possibility.

Though not specifically covered here, state and local tax agencies may also adopt or decouple from some or all of the changes in the OBBB, necessitating thorough consideration before modifying any tax planning or arriving at any conclusions.

Call to Action

Taxes can be complex, confusing, and ever-changing. At Whittier Trust, we focus on Washington, ensuring your tax plan is tailored to today’s realities. We can help you take a step back and holistically examine how taxes impact your life goals and objectives and plan for the future accordingly.

The Whittier Trust Company of Nevada is proud to announce the promotion of Derek S. Hamblet to Senior Vice President and Client Advisor in the wealth management firm’s Reno office. This advancement reflects both Derek’s nearly two decades of experience and the firm’s deepening dedication to serving Nevada families, who benefit from the state’s advantageous trust laws and robust fiduciary framework.

The Whittier Trust Company of Nevada is proud to announce the promotion of Derek S. Hamblet to Senior Vice President and Client Advisor in the wealth management firm’s Reno office. This advancement reflects both Derek’s nearly two decades of experience and the firm’s deepening dedication to serving Nevada families, who benefit from the state’s advantageous trust laws and robust fiduciary framework.