Dichotomies and Bifurcations

After consecutive years of strong returns, global stock markets were expected to take a breather and slow down in 2025. Those expectations seemed to be on track during the first two quarters. After a solid start to the year, prospects of a global trade war raised the specter of a recession and led to a manic selloff in stocks. The worst fears on the trade front, however, proved to be ephemeral as trade tensions de-escalated and markets rebounded sharply.

After a topsy-turvy first half of the year, U.S. stocks have continued to climb one wall of worry after another in recent weeks. The resilience of the stock market has now propelled it to multiple new all-time highs. While investors cheer the wealth effect from higher stock prices, they also worry about some valuation metrics that are now at levels observed during the Internet Bubble.

The economic and market backdrop around us is replete with mixed signals that offer both cause for concern and reason for optimism. We briefly highlight and contrast some of these competing forces.

On a positive note, overall business activity in the third quarter appears robust, corporate profits are strong and impending fiscal and monetary stimulus are poised to act as tailwinds in 2026. However, the skeptics point out that most consumers are still struggling, the U.S. economy is narrowly propped up only by AI spending with pervasive weakness elsewhere, U.S. job growth has slowed considerably in recent months, and stock valuations appear to be alarmingly high.

We are sympathetic to the confusion arising from these mixed signals. We offer our readers more clarity on the state of the economy and the markets by examining these topics in greater detail and nuance. The four concerns above are divided into the following two themes of bifurcation and dichotomy. Bifurcations refer to extreme variations in a single metric while dichotomies highlight contrasts across multiple metrics.

- The Bifurcated U.S. Consumer and Economy

- Dichotomies in the U.S. Job Market and Stock Valuations

The Bifurcated Consumer

The eventual impact of tariffs on inflation is still unknown. As we have maintained throughout the year, we believe it will be more muted than most expectations.

Nonetheless, one of the regressive realities of the global trade war is that tariffs have adversely affected lower income households more than they have higher income households. Categories like food, toys, appliances, and furniture make up a bigger percentage of household expenses for these consumers and reduce their overall ability to spend.

However, this asymmetrical effect of tariffs on consumer spending across households is the more benign bifurcation theme for the consumer.

The other sad and socially undesirable reality of U.S. consumer spending is the uneven share of overall consumer spending across income categories. The U.S. consumer is incredibly bifurcated in this regard. The top 10% of households by income account for almost 50% of all consumer spending.

In this setting, even as most lower income consumers find it increasingly difficult to spend, their inability to do so only has a muted impact on overall consumer spending. In a labor market with few job losses, high income consumers continue to spend.

The “top-heavy” consumer also benefits from another powerful and asymmetrical tailwind, i.e. the wealth effect. High income consumers have higher home and stock ownership within the overall population. The stunning appreciation in home and stock prices in recent years has also triggered a disproportionately bigger increase in their net worth.

While most consumers are indeed struggling, the bifurcated high-end consumer is almost singlehandedly supporting U.S. economic growth.

The Bifurcated U.S. Economy

Here is a brief recap of economic activity in 2025.

The trajectory of GDP growth in the first half of 2025 mirrored the inversion in the stock market. Prospects of higher future tariffs led businesses to speed up their purchases of foreign goods in the first quarter of 2025.

As a result, imports rose sharply in that period. In the realm of GDP calculations, exports are additive to GDP and imports are detractors from GDP. The significant spike in imports played a major role in the final -0.5% GDP growth rate for the first quarter.

Not surprisingly, this trend reversed in the second quarter. Imports fell dramatically and consumer spending rebounded as consumers were spared the worst impact of tariffs. As a result, GDP growth in the second quarter was unusually strong at +3.8%. Therefore, combined GDP growth in the first half of 2025 was a modest +1.6%, an outcome far better than investors’ worst fears. In an even more remarkable development, estimated third quarter GDP growth is clocking in at a scarcely believable +3.9% rate as of mid-October.

The economic picture painted so far is hardly worrisome. Why then are consumers concerned about the economy when the overall numbers look respectable and even reassuring?

The answer to this question lies in another theme of divergence: In 2025, the U.S. economy is conspicuously bifurcated with limited leadership. The skeptics point out that the U.S. economy is being held up almost exclusively by investments and spending in AI, while the rest of the economy is stagnant and sluggish. More granular economic data bears this out and is remarkable enough to warrant a quick mention.

As the U.S. economy evolves, investment in information processing equipment and software has grown to about 5% of overall GDP. However, in the first half of 2025, it was responsible for more than 90% of GDP growth! The four “hyper-scalers” in AI (Microsoft, Amazon, Google and Meta) have spent more than $300 billion in capital expenditures for AI infrastructure in 2025. Absent this AI spending, GDP growth in the first half of 2025 would have been a meagre +0.1% instead of +1.6%. A stunning bifurcation indeed.

The sheer scale of such spending has raised fears of an “AI bubble” and the narrow base of the current economic launchpad has raised questions about the fragility and sustainability of GDP growth. In the worst-case scenario, investors worry that if all AI investments eventually come to naught, a deep recession and a prolonged bear market will inevitably follow. If AI ends up at other levels of hype short of the worst case, the outlook will still be quite negative.

The future of AI is a profound topic by itself and best addressed in a deeper dive within a future article. Our focus here is to highlight the unusual bifurcation in the U.S. economy and to analyze the risks that it poses in the future. We highlight two observations to defuse concerns about the current AI-fueled economy.

Not All AI Spending is Speculative

First, we assess if all AI investments and companies are in a speculative bubble already. We believe that we are not in a pervasive AI bubble at this point. Most of the companies at the forefront of large AI investments enjoy strong revenues, profitability and free cash flow. However, the payoff from this spending will clearly have to come from higher productivity growth in the future.

History has shown that productivity has generally moved higher during periods of growth and innovation. The desired pattern of rising productivity growth is already playing out in this current postpandemic cycle of technological innovation.

Productivity growth was low in the aftermath of the pandemic and has risen meaningfully since then. We believe we are still in the early innings of the AI revolution and expect productivity to rise for several more years. We assign a low probability to a future outcome where most AI spending eventually proves to be unproductive or even useless.

While these observations speak to the overall AI outlook, there are some serious caveats to bear in mind. Speculative “mini bubbles” are already building up in the technology and AI space. There are several unprofitable technology companies that are up over 100% this year. There is a fair share of companies that are trading at Price-to-Sales ratios of over 100!

Somewhat alarmingly, a tangled, opaque, complex, and circular web of investing and financing is now emerging within a small group of AI players. We urge extreme caution in investing in this space and encourage our readers to steer clear of speculation, fashions and fads.

More Diversified Growth Drivers in 2026

Second, we believe that the drivers of economic growth in 2026 are about to get diversified beyond this narrow AI leadership. It is estimated that the One Big Beautiful Bill will add about $300 billion in fiscal stimulus to the U.S. economy in 2026. Investors can also expect monetary stimulus to play out in tandem with fiscal stimulus. The Fed has resumed its easing cycle in the face of a weaker job market and will likely cut interest rates 2 or 3 more times in the coming months. The administration may also be able to embark on some of its pro-growth deregulation initiatives.

The market has already detected and priced in this shift in economic drivers. Earnings estimates have been revised higher, prices have risen on future growth expectations and, most importantly, the market is now rewarding a broader swathe of sectors, such as small cap stocks and cyclical stocks, ahead of this broadening of growth drivers. These developments also help explain the latest spurt in the Price-toEarnings multiple for the broad market; Prices have already moved in anticipation of eventually higher future Earnings.

We move to the closing half of the article to highlight some dichotomies in the job market and stock valuations. We believe these insights may allow investors to view their concerns on the two topics in a different light.

Dichotomies in the Job Market

The current weakness in the U.S. job market is well recognized and a source of concern to many. Major declines in job growth have often led to a weaker consumer, lower spending, increased layoffs and a substantial rise in unemployment … all key ingredients in the recipe for a recession.

We agree that this conventional extrapolation would normally be problematic. We have already seen the beginning of this potential sequence. Job growth has tapered off substantially from May onwards; we are now officially in a “No-Hire” job market. But what about the knock-on effects listed above? Are they proceeding along conventional lines, or is there a dichotomy at play in the job market?

We observed earlier that third quarter GDP growth is galloping ahead at an estimated +3.9%. Clearly, we are not seeing a big decline in consumer spending. The paradox of weaker job growth and yet solid consumer spending is partially explained by the bifurcated consumer above; it is also explained by unusual employment trends.

The "No-Hire, No-Fire" Job Market

For all the upheaval and turmoil in 2025, the unemployment rate has stayed remarkably steady between 4.1% and 4.3%. Even more strikingly, the employment-to-population ratio for people in the prime 25-54 working age group has held rock-steady in the 80-81% range throughout the year. These unusual employment outcomes can be traced to the dichotomy between new hires and layoffs in 2025.

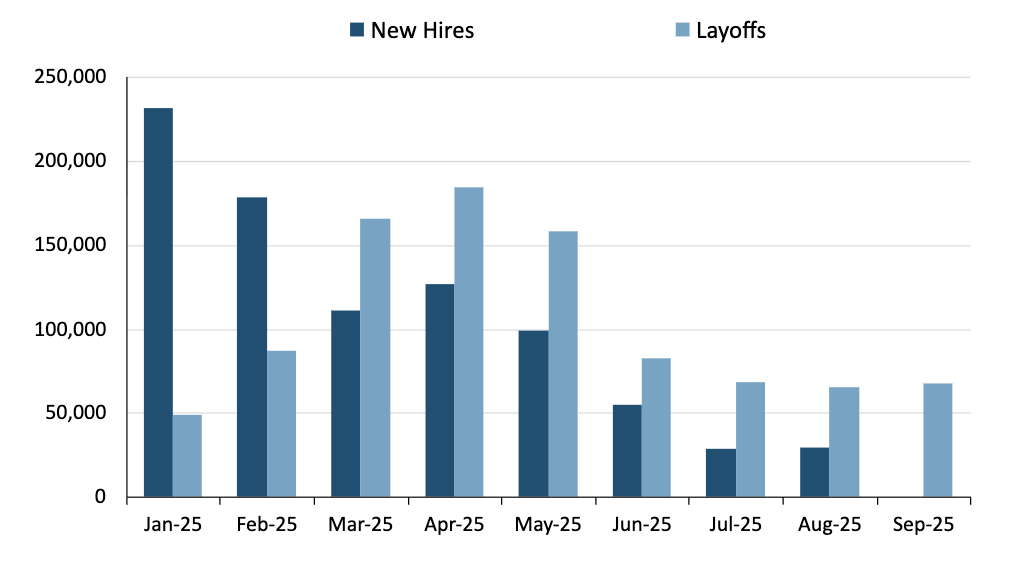

We show these two metrics in Figure 1.

Figure 1: New Hires and Layoffs in 2025

Source: Bureau of Labor Statistics, Challenger, Gray and Christmas, 3-month moving averages, as of Aug-Sep 2025

We show more stable trends in new hires and layoffs by computing 3-month moving averages in Figure 1. The dark blue bars show new hires; the light blue bars show layoffs. This visual depiction alters the narrative on the job market in a meaningful manner.

When layoffs mounted from government spending cuts in early 2025, job growth was still strong; when job growth declined meaningfully, so did layoffs. The current level of layoffs is in line with a normal economy and no worse. We describe the current state of the job market as a hyperbolic, but succinct, oneliner: “Nobody’s getting hired, and nobody’s getting fired!”

There are important implications of this “No-Hire, No-Fire” job market. Most consumers are still gainfully employed. When people have a job, they can continue to spend. The headlines so far have focused mainly on the “No-Hire” component of the job market. The “No-Fire” addendum to the storyline is an important circuit-breaker in the normal cycle of no jobs, weak consumer, low spending, big layoffs, high unemployment and an eventual recession.

We believe the dichotomy between new hires and layoffs is useful in understanding the true state of the labor market and its potential impact on the economy.

Dichotomies in Stock Valuations

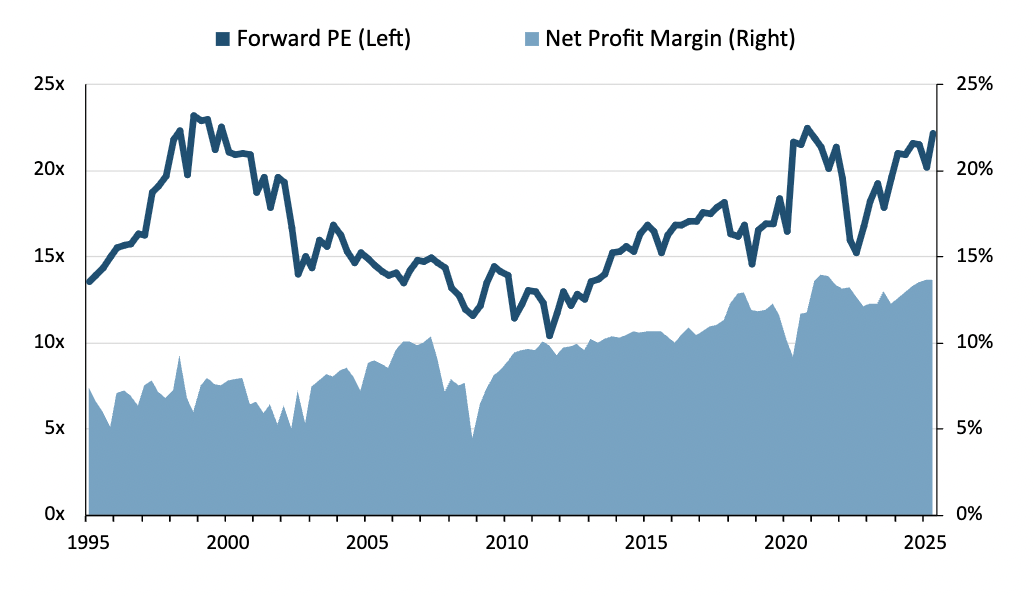

We observed at the outset that some valuation metrics today are close to levels seen in the Internet Bubble at the turn of the century. The Forward Price-toEarnings ratio (“Forward PE”) is one such metric. The Forward PE ratio is derived by dividing today’s price by the next 12 months of earnings.

The Forward PE was just above 23 at the peak of the Internet Bubble; it has hovered in the 22-23 range for the last several weeks. This high valuation has investors worrying about another “bubble” … a stock market valuation bubble whose collapse may trigger a -30% decline in stock prices.

We acknowledge that the current Forward PE of 22.4 is undeniably elevated. However, we believe it is nowhere close to being a bubble. We assign a low probability to a devastating broad-based bear market triggered by valuations alone.

We support our bold, constructive outlook above by drawing on one more dichotomy to compare valuations in 2025 and 1999.

While the Forward PEs are similar, there is one big difference in company fundamentals. U.S. companies have led the world in innovation over the last few decades. As a result, they are also significantly more profitable than before.

Figure 2 shows how Forward PEs and net profit margins have changed over time.

Figure 2: Forward PEs and Net Profit Margins

Source: Bloomberg, as of Q2 2025

The dark blue line represents the Forward PE, and the light blue mountain chart shows net profit margins.

We see that profit margins have risen steadily over time. The sporadic breaks in profitability coincide with recessions such as the ones seen during the Global Financial Crisis and the pandemic. Companies are almost twice as profitable today as they were 25 years ago; margins have grown from 7-8% back then to 13-14% today. The steady growth in profit margins, in turn, has created higher returns on equity and higher organic earnings growth.

The dichotomy in profitability between the mid-2020s and the late 1990s in large part refutes any credible parallels in the risks of high valuations between the two eras. We view those high valuations as more speculative; today’s valuations are more supported by fundamentals. We expect valuations to come down gradually over the next few years but without creating a major price decline as earnings continue to grow.

We hope these brief discussions provide additional insights and allay some of the concerns related to jobs, valuations and bubbles.

Summary

We recognize that the job market has become weaker in recent months, AI is an unusually large part of the economy right now, and stock market valuations are on the high side. Nonetheless, we do not foresee a major economic slowdown or stock market setback for the following reasons.

- Consumer spending is disproportionately driven by the bifurcated high-income consumer, who continues to spend on the heels of strong income and wealth effects.

- While AI spending is largely supporting current economic growth, growth drivers will become more diversified in 2026 to include fiscal stimulus, lower interest rates and deregulation.

- Weaker job growth has been offset by fewer layoffs. As consumers keep their jobs in a “NoHire, No-Fire” job market, they are able to maintain their spending.

- Current stock valuations are less speculative and more supported by higher profitability and stronger company fundamentals. We see little risk of a stock market crash based on stock valuations alone.

We do see pockets of speculative activity and frothy prices in some technology and AI stocks. We avoid low quality companies in general at all times; we are especially careful about circumventing them now in this area. We see few opportunities for outsized gains in the backdrop of relatively high valuations. We remain vigilant and careful in managing client portfolios during these complicated times.

To learn more about our views on the market or to speak with an advisor about our services, visit our Contact Page.

While most consumers are struggling, the bifurcated high-end consumer is almost single-handedly supporting U.S. economic growth.

Growth drivers will become more diversified beyond AI in 2026 to include fiscal stimulus, lower interest rates and deregulation.

Weaker job growth has been offset by fewer layoffs.

Current stock valuations are less speculative and more supported by strong company fundamentals.

From Investments to Family Office to Trustee Services and more, we are your single-source solution.