The right investment and estate strategy can help create a legacy of real estate holdings that will benefit your family for generations.

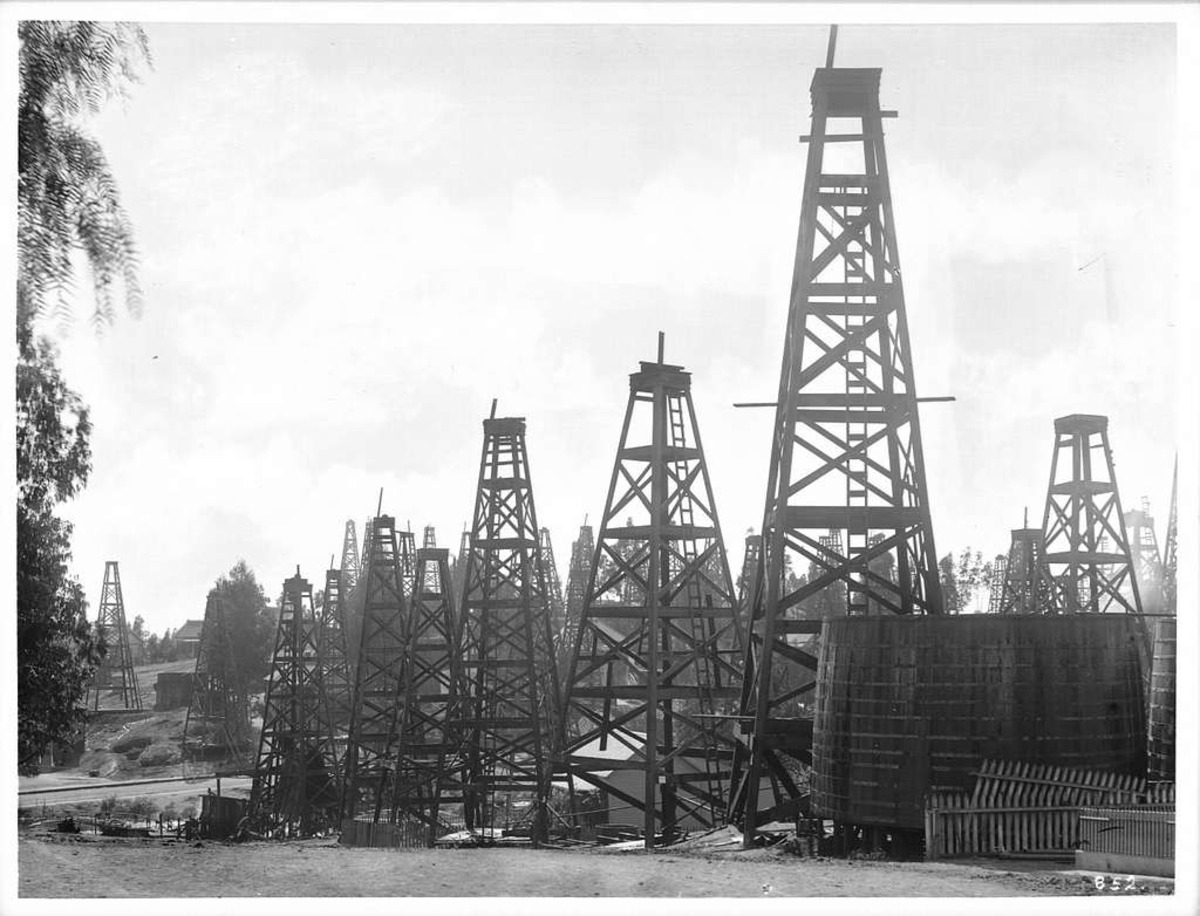

In 1891 just before the turn of the century, a young man from Maine named Max Whittier rode a train cross-country to California to seek his fortune. Nearly a decade later, after several failed attempts to find oil, he risked his life savings of $13,000 on land along the Kern River in the southern Sierra Nevada mountains northeast of Bakersfield. By 1903, the area was the top-producing oil field in the nation. Whittier kept the land rather than selling it for a quick profit, and today Kern River remains one of the largest oil fields in the continental U.S.

In 1891 just before the turn of the century, a young man from Maine named Max Whittier rode a train cross-country to California to seek his fortune. Nearly a decade later, after several failed attempts to find oil, he risked his life savings of $13,000 on land along the Kern River in the southern Sierra Nevada mountains northeast of Bakersfield. By 1903, the area was the top-producing oil field in the nation. Whittier kept the land rather than selling it for a quick profit, and today Kern River remains one of the largest oil fields in the continental U.S.

Out of the wealth Max Whittier created as a pioneer in real estate, oil, and gas, Whittier Trust was established in 1935 to manage the family’s assets for his four children. In 1989, the company expanded to serve other families, ultimately creating a platform that comprises five core pillars of wealth management:

“These five pillars give us great latitude to tailor investment strategies to individual client goals as part of our multifamily office services,” says Andrew Paulson, who manages a $2B real estate portfolio of diverse asset classes across the U.S. as Vice President of Real Estate at the Whittier Trust Pasadena office. “Many wealth management firms specialize and don’t provide real estate services. But at Whittier, active investment and management of real estate has been part of our platform for over 100 years.”

The Rewards of Real Estate

Real Estate is a unique investment class that performs differently from stocks, bonds, or other investment vehicles. Here are some of the primary reasons why Whittier Trust encourages clients to invest in real estate:

- Investors have much greater control over property ownership than owning a small sliver of a company through shares of stocks.

- Although real estate is considered illiquid, real estate values are much less volatile than share prices.

- Real estate is a good hedge against inflation as rents and values typically increase with inflation.

- Real estate requires local knowledge. Understanding what is happening on Main Street is as important as what is happening on Wall Street.

“A major differentiator for Whittier Trust is that if a client comes to us with an extensive real estate portfolio our team can hold those real estate assets as a fiduciary, or we can serve as an investment advisor over those assets,” explains Paulson. “In addition, for trusts with real estate assets, we have the ability to serve as trustee, which is a rare advantage among asset management firms.”

“At the same time, our real estate group actively sources new investments that clients can add to their overall real estate allocation,” Paulson continues. “Our firm portfolio consists of Multifamily, Industrial/Commercial, Office, Retail and Flex Space properties, and we have a broad list of qualified sponsors who are sourcing deals across the country. Throughout the history of the firm client demand has remained very strong for these direct real estate investments and all recent opportunities have been oversubscribed. We are currently focused on sourcing more acquisition opportunities for multifamily and industrial assets to continue to broaden our list of experienced partners and sponsors.”

Estate Planning to Preserve Your Real Estate Portfolio

We’re all taxed on our possessions when we die, and there are only two ways to reduce that tax. You can have fewer possessions, or you can decrease the value of those possessions. Real estate owners are uniquely situated to do both, and Whittier advisors have unique expertise in this area, from initial planning to settling the estate.

Reducing what you own is the first step. Under current law, an individual can give away $11.5 million of assets without incurring gift (or estate) tax. A married couple can give away twice that amount, or $23 million. So if a real estate owner had a property worth $11.5 million, he or she could give the entire property away within the amount of his or her exemption. That exemption amount is scheduled to be cut in half in 2026.

That brings us to the second step: reducing the value of what you own. Whittier Trust helps real estate owners use another advantage related to estate planning—owning assets inside of entities. We help owners make gifts of their interests in entities while taking valuation discounts for lack of control and lack of marketability (which appraisers typically discount in the range of 30 to 40%). For example, a real estate owner holding a building in an LLC, structured with a typical 1% managing member interest and a 99% non-managing member interest, can gift their 99% non-managing member interest with a 30% discount.

When a real estate investor passes away, even though estate taxes can often be paid over a 14-year period, the cash flow needed to make those tax payments can greatly reduce the cash available to provide for the family. Or worse, for investors with significant portfolios, such assets may need to be sold to pay estate taxes, and the owner's efforts in putting together a real estate portfolio can be lost—often a lifetime accumulation of irreplaceable assets. With proper estate planning, however, those assets can be maintained to provide support for future generations.

The Nevada Advantage for Multigenerational Wealth

If properly planned, real estate assets can pass not only from the real estate owner to his or her children, but also on to his or her grandchildren by taking advantage of the generation-skipping transfer tax exemption. Whittier Trust helps real estate investors use strategies of gifts or sales to trusts for family members to allow the real estate assets of those trusts to be properly administered for beneficiaries in the future.

If properly planned, real estate assets can pass not only from the real estate owner to his or her children, but also on to his or her grandchildren by taking advantage of the generation-skipping transfer tax exemption. Whittier Trust helps real estate investors use strategies of gifts or sales to trusts for family members to allow the real estate assets of those trusts to be properly administered for beneficiaries in the future.

“In California, most trusts have termination clauses that restrict a family’s sharing of legacy assets,” Paulson says. “Under state law, trusts have a maximum duration of 90 years (or no more than 21 years after the death of an individual alive at the time the trust was created). Whittier Trust Company of Nevada was specifically created to help California families protect their wealth with the Nevada advantage. Residency is not required to transfer those assets to Nevada-domiciled trusts which under Nevada law permits a trust to remain in effect for 365 years.”

In keeping with Max Whittier’s vision for the land he invested in more than a century ago, Whittier Trust believes real estate is an important component in building lasting family wealth. For clients wanting to pass a portfolio of properties down to children and grandchildren, these long-term trust strategies are just a few of the ways that we help you share that wealth with successive generations.

To learn more about how the right estate planning strategies and real estate portfolio management can help benefit your family for generations, start a conversation with a Whittier Trust advisor today by visiting our contact page.

From Investments to Family Office to Trustee Services and more, we are your single-source solution.