THE GYRATION IN OIL PRICES over the past 18 months has left many questions about the direction of oil prices and how to position an investment portfolio. The price of oil collapsed from over $100 per barrel (bbl) to a low of $26/bbl. Since then, oil prices have nearly doubled to approach $50/bbl.

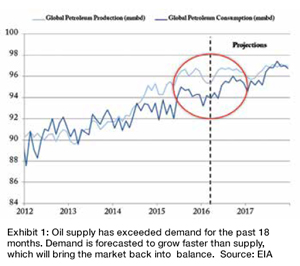

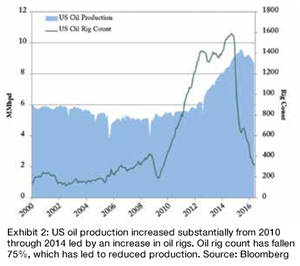

While the price of a barrel of oil has always been volatile, the global consumption of oil has grown virtually every year. The world will consume over 96 million barrels of oil per day by the end of 2016, nearly 1.5 million more than 2015. The one common characteristic of oil price declines is the eventual recovery in the price of oil. Last year’s price decline will not be an exception. Supply and demand imbalances are dissipating and oil prices are recovering.  Oil producers have slowed down plans to drill new wells and consumers have switched from hybrids back to SUVs. Ford recently reported record SUV sales while Toyota is selling more trucks and SUVs than ever before as consumers adjust to low gas prices.

Oil producers have slowed down plans to drill new wells and consumers have switched from hybrids back to SUVs. Ford recently reported record SUV sales while Toyota is selling more trucks and SUVs than ever before as consumers adjust to low gas prices.

As long-term investors, we look at every market through the lens of opportunity. As the oil market rebalances, we see profit potential in exploration and production companies with low debt levels and low break-even cost structures. Beyond positioning within portfolios, the current market environment may prove to be an opportune time to review strategic estate planning opportunities. With oil prices still down 50% from two years ago, owners of direct oil and gas assets can seize this rare occasion to shift assets at low valuations to future generations reducing taxes along the way.

Whittier Trust’s oil and gas expertise has added tremendous value for our clients over 75+ years.  We have operated oil and gas fields, managed stocks and bonds of public and private oil & gas companies, purchased and sold working interests, royalty interests and net profit interests, served on Boards and actively managed public and private companies. With a focus on maximizing after-tax wealth over long time horizons, we have a proven track record in Oil and Gas, direct Real Estate, long-term capital appreciation and tax-efficient income generation. These collective insights have allowed Whittier Trust’s clients to perpetuate, enhance and transition wealth inter-generationally.

We have operated oil and gas fields, managed stocks and bonds of public and private oil & gas companies, purchased and sold working interests, royalty interests and net profit interests, served on Boards and actively managed public and private companies. With a focus on maximizing after-tax wealth over long time horizons, we have a proven track record in Oil and Gas, direct Real Estate, long-term capital appreciation and tax-efficient income generation. These collective insights have allowed Whittier Trust’s clients to perpetuate, enhance and transition wealth inter-generationally.

Our proprietary insights in oil and gas investments contribute to our core business of maximizing inter-generational wealth. We welcome the opportunity to help you accomplish your legacy goals through investment management, fiduciary, philanthropy and family office services. If you would like to learn more about how to benefit from this insight, please contact Whittier Trust at 800.971.3660.

From Investments to Family Office to Trustee Services and more, we are your single-source solution.